Ghana rolls out MyCreditScore to deepen financial inclusion

In a major stride towards improving financial inclusion and enhancing credit access, Vice-President Mahamudu Bawumia, has launched a new credit scoring system, dubbed MyCreditScore. This innovative platform aims to make credit more accessible and affordable for Ghanaians, allowing individuals and businesses to more easily obtain loans and financing based on their credit history and financial … The post Ghana rolls out MyCreditScore to deepen financial inclusion appeared first on Asaase Radio.

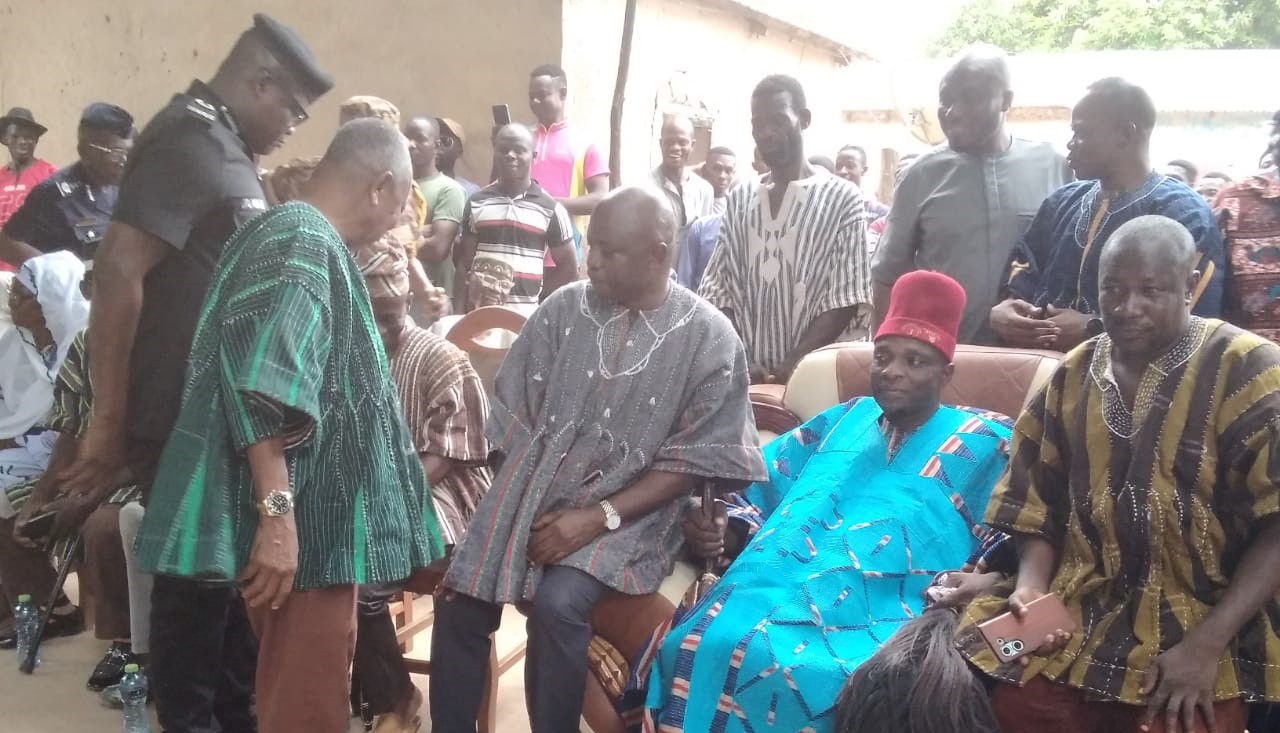

In a major stride towards improving financial inclusion and enhancing credit access, Vice-President Mahamudu Bawumia, has launched a new credit scoring system, dubbed MyCreditScore.

This innovative platform aims to make credit more accessible and affordable for Ghanaians, allowing individuals and businesses to more easily obtain loans and financing based on their credit history and financial habits.

The successful launch of the credit scoring system for Ghana, is a culmination of a dream which started 17 years ago when Mahamudu Bawumia was deputy governor of the Bank of Ghana, leading to the passage of the Credit Reporting Act by Parliament in 2007.

Revolutionizing Ghana’s Financial Sector

Speaking at the launch in Accra on Thursday(7 November), Bawumia emphasized that MyCreditScore is poised to transform Ghana’s financial landscape by offering a fair and consistent way to assess creditworthiness.

This individualized credit scoring model will evaluate users based on payment history and financial behaviours, making it easier for Ghanaians to build credit profiles, access financing, and make cash-free purchases.

Bawumia noted that the initiative aligns with the government’s commitment to a digitized and inclusive economy, underscoring MyCreditScore as a key step towards sustainable economic growth.

“For the first time, Ghanaians will have access to a credit score that can open doors to improved financing options, helping them to realize their goals and contribute to economic growth,” he said.

He added that the system rewards responsible financial behaviour, enabling Ghanaians to transparently and confidently demonstrate their creditworthiness.

Collaborative effort

The development of MyCreditScore has been a joint effort involving private sector partners and the Bank of Ghana, which has prioritized creating a reliable credit information system to bolster risk management within the financial sector.

The head of banking supervision at the Bank of Ghana, Osei Gyasi, noted the central bank’s dedication to supporting this system, emphasizing its role in promoting responsible lending practices and reducing the rate of Non-Performing Loans (NPLs) that currently strain financial institutions.

Board Chairman of MyCreditScore, Augustine Adjei, also expressed optimism about the system’s success, stating that data suggests high potential for widespread adoption and positive impact on Ghana’s financial landscape.

Benefits for financial institutions and consumers

One of the core objectives of MyCreditScore is to create a financial environment that fosters trust between borrowers and lenders.

Bawumia highlighted that the system would promote responsible lending practices by providing financial institutions with more accurate assessments of individuals’ creditworthiness.

He also noted that individuals with strong credit histories would benefit from tailored financial products, as banks will seek out creditworthy customers.

Additionally, MyCreditScore is expected to ease financial burdens on consumers by allowing credit-based transactions without requiring cash upfront, making it simpler for Ghanaians to build positive credit records.

A vision for digitized economy

Bawumia positioned MyCreditScore as part of a broader vision of digital transformation in Ghana.

The initiative builds on ongoing efforts to integrate national databases and enhance the information content available within the financial ecosystem.

“With what we are putting together in Ghana with carding and integration of our various databases, the information content of Ghana’s credit score is going to be much higher than in many advanced nations,” he said.

By improving access to credit and incentivizing financial responsibility, the MyCreditScore platform is expected to support Ghana’s economic resilience and contribute to the country’s broader development goals.

MyCreditScore will be accessible to all Ghanaians, with banks, financial institutions, and merchants encouraged to integrate the system into their operations to foster a more inclusive financial system for everyone.

Reporting by Philip Abutiate in Accra

Asaase Broadcasting Company airs on Asaase 99.5 Accra, Asaase 98.5 Kumasi, Asaase 99.7 Tamale, Asaase 100.3 Cape Coast, AsaasePa 107.3 (Accra).

Affiliates: Bawku FM 101.5, Bead FM 99.9 (Bimbilla), Mining City Radio 89.5 (Tarkwa), Nandom FM 101.9, Nyatefe Radio 94.5 (Dzodze), Sissala Radio 96.3 (Tumu), Somuaa FM 89.9 (Gushegu), Stone City 90.7 (Ho) and Wale FM 106.9 (Walewale).

Listen online: asaaseradio.com, Sound Garden and TuneIn.

Follow us:

X: @asaaseradio995, @Asaase985ksi, @Asaase997tamale, @asaase1003, asaasepa1073

Instagram: asaaseradio99.5, asaase985ksi, asaase100.3, asaase99.7tamale, asaasepa107.3

LinkedIn: company/asaaseradio995. TikTok: @asaaseradio99.5

Facebook: asaase99.5, asaase985ksi, Asaase100.3, asaase99.7, AsaasePa107.3.

YouTube: AsaaseRadioXtra.

Join the conversation. Accra: call 020 000 9951/054 888 8995, WhatsApp 020 000 0995. Kumasi: call 059 415 7985 or call/WhatsApp 020 631 5260. Tamale: call/WhatsApp/SMS 053 554 6468. Cape Coast: call/WhatsApp 059 388 2652.

#AsaaseRadio

#AsaasePa

#TheVoiceofOurLand

The post Ghana rolls out MyCreditScore to deepen financial inclusion appeared first on Asaase Radio.